Districts respond to $19m fraud

Liability argued among KCCD, KCSOS and Treasurer-Tax Collector

March 30, 2017

The Kern Community College District and Kern County Superintendent of Schools have issued a joint letter in response to the disappearance of a combined $19 million from both institutions’ Wells Fargo accounts.

The theft, which, according to Kern County Treasurer-Tax Collector Jordan Kaufman in a report by the Bakersfield Californian, occurred over two or three years, primarily targeted the KCCD, from which $16.4 million was taken. The KCSOS has suffered a loss of $2.6 million. So far, efforts have “recovered almost 80 percent of the funds,” said Kaufman on March 27.

The letter, signed by KCCD chancellor Tom Burke and superintendent of schools Mary Barlow and dated March 21, goes through the order of events in discovering the fraudulent activity beginning in January and assures readers that they are “working together with the County’s Treasurer-Tax Collector and its bank, Wells Fargo, along with the Auditor Controller, the District Attorney’s office and the F.B.I. to identify those responsible for the theft and recover the funds that have been stolen.”

The letter also claims comments to the media have led to confusion in the public.

“Unfortunately, since the discovery of this fraud, the County Treasurer and Auditor-Controller have made statements and/or released copies of documents to the media without consulting with us. This has led to confusion and misinformation to the general public and our partner agencies.”

The large majority of the theft occurred from the agencies’ payroll clearing accounts, which were “established exclusively for payroll payments to school district employees,” according to the letter’s attached fact sheet.

The fact sheet asserts Kaufman and his office as the party responsible for watching over the afflicted accounts.

“The law imposes a legal duty on the Treasurer-Tax Collector to serve as a ‘trustee’ for those funds. This requires the highest degree of trust, good faith and honesty to safeguard school agency funds, as a matter of law.”

In response to the question of how education agencies authorize payments, the fact sheet further implies that responsibility for the fraud lies with Kaufman’s office. Operating on a “positive pay” system, the Treasurer-Tax Collector and bank are given a list of approved expenditures from the education agencies. No payments exceeding that approved list are allowed.

“Neither the Treasurer-Tax Collector / Auditor-Controller nor Wells Fargo reported that any payments were being made beyond the positive pay instructions given by the education agencies at all times material to the fraudulent transactions. Nor did the Treasurer-Tax Collector or Wells Fargo inform the education agencies that non-payroll expenditures were being processed through the account reserved exclusively for payroll,” according to the fact sheet.

The fact sheet goes on to assure community partners that they “expect no losses will be absorbed by the education agencies because the Treasurer-Tax Collector, the Auditor-Controller and Wells Fargo did not disburse our funds strictly in accordance with our positive pay instructions and the Treasurer’s trusteeship responsibility.” In simpler terms, no losses are expected by the KCCD or KCSOS because safekeeping of the funds is not their responsibility, according to the fact sheet.

This is not how Kaufman sees the situation, according to a report by The Bakersfield Californian on March 23 following the letter’s release. Kaufman allegedly provided The Californian with letters from the AuditorController’s office, written in 2005, that makes clear that the KCCD and KCSOS would be responsible for reconciling account funds going forward.

“The joint letter appears to be an attempt by the two districts to redirect attention from that responsibility,” said Kaufman in the report. “While the county has provided documentation to back up any claim that it has made, the districts have not provided any documentation to date. Therefore, at this point, I do not feel it necessary to respond to any baseless claims made in the letter.” The joint letter also claims that neither district had access to the afflicted accounts until February 2017. Kaufman also told The Californian that while the letter “has many inaccurate statements, my office continues to work with both districts and the bank to recover as much money as possible from the perpetrators of this crime.”

In a statement to The Rip on March 27, Kaufman said, “At this time I am 100% focused on the recovery efforts because that is the most important thing right now. … We continue to get money back every day and that process will take at least another few months. We will exhaust every avenue possible to get every penny back that we can. The taxpayers deserve to have our full attention on the recovery efforts.”

Matthew Basey • Mar 2, 2019 at 7:25 pm

I know exactly how this happened. I’m the guy who contacted the F.B.I.

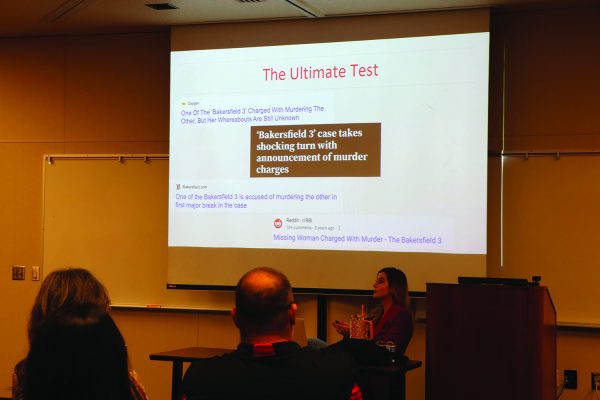

In 2005, the slush fund was established and those (crooked county employees) in the know have been using our tax dollars to pay their bills. It’s as simple as that. I contacted Kevin McCarthy two times before going to the F.B.I. How could I have known that he didn’t want this discovered? Turns out he was likely in the know as well which became crystal clear after discovering that he endorsed Tkac for city council. I expect that I will go the way of the Bakersfield Three after having gone full disclosure to the F.B.I. a second time, the V.A. and Bakersfield Police Department but I have zero fux left to give.

Rest assured, I got many a laugh out of what I have dubbed “Operation Sneak Attack Booty Crack”. If I die for standing up for the Constitution of the United States, so fuking be it.

Shrimp or fries…….I made the trash take itself out!

Liza Sanchez • Jul 28, 2017 at 1:01 pm

Who did it ? Weird that so many utilities were paid “randomly” ?!!

Liza Sanchez • Jul 28, 2017 at 1:00 pm

Any update on how this fraud happened ?